Risky behavior, we do it without a second thought. You take a distracting call as you’re speeding, weaving in and out of traffic, read or fumble a quick text at a red light finishing as you accelerate into the green light, or ignore the possibility of black ice all on 5 hours of sleep.

The odds you’ll get hit are small and the average consequence is a tow out of the ditch or a fender bender. We don’t think about the “tail-end consequences” of getting hit or hitting someone else.

In 1996, my husband, younger brother, a friend and I were thinking about attending the Olympic opening ceremonies in Atlanta on July 27, but I think their flight was delayed causing us to miss the Olympic Park bombing.

In 2001, my husband and I flew into Dulles airport a few days prior to September 11.

In 2006, we were on the top floor of a Honolulu hotel on October 15 when a 6.7 magnitude earthquake hit knocking the power out to the entire island for the day, having to take the stairs 15 flights down, standing in long lines to buy whatever food you could grab in the dark and missing out on Pearl Harbor.

In 2016, we flew out of Brussels airport on the same day a week prior to the suicide bombings at the airport on March 22.

These were inconceivable, tragic events that we would never imagine would happen, especially so close to us having been there. Each one changed our perception.

“Risk is what you don’t see,” Morgan Housel, Same as Ever.

Risk is personal and the perception of it differs for everyone. What you see as risky, someone else may view as not.

We assumed the home inspector tested the smoke/CO detectors before we bought our current house. It wasn’t until we got around to having an alarm system designed that it was discovered the detectors were no longer hard wired into a panel in the basement utility room. It had been removed when the former owners moved out. Carefully reading the home inspection report, it stated the detectors were observed, no mention that they were functional. How often do you hear on the news after a fatal fire that the house had no working smoke detectors?

Growing up, the house next door burned beyond repair. Another night, the auto body shop a block away had flames shooting out of it and the bar where we weren’t carded burned to the ground. If you never had any real-life experience seeing a fire consume a house or building, you don’t see the risk.

There is inherent risk in virtually everything we do in life. Whether you consciously realize it or not, you are accepting a level of risk in whatever you do. We still fly, travel and go to events. Our risk acceptance is influenced by our experience, wisdom and values as we age.

Risk isn’t some tangible thing you can put your finger on to adjust like the volume on your screen moving it up for some events and scaling it back for others. You can calculate your level of risk by doing quantitative analysis, taking risk questionnaires or trying to avoid it as much as possible with risk aversion. For most things, you know the odds are small and within your experience you understand the consequences. There isn’t any risk adjustment you make when you get into your car each day to drive.

We utilize risk management with preparedness, insurance, education and experience. Everyone has car insurance, but it doesn’t cover a vehicle that has mechanical issues. A decade ago, I bought a new Jeep Grand Cherokee with my company discount, it was great until the dealer couldn’t figure out what was wrong with it so even the warranty became useless. I traded it in for a used Lexus, the most reliable vehicle at the time until something else happened.

Many of us also have our mechanic service our vehicle, checking it over before a long road trip but there are things they don’t see, and you certainly don’t. Like the solitary lug nut that was bolted to the front tire after the tire rotation. We drove it like this from LA to Phoenix on the desert super expressway at 80+ mph until we noticed highly unusual shaking and difficult steering. A local tire shop found the issue and provided the 4 missing lug nuts using extra scrutiny to tightly bolt them in. They were astounded the tire had not come off.

Gaining lived experience as well as failing early allows you to take on more calculated risks. If your mindset is fixed on “failure is not an option,” you are terrified to even experience it in whatever context. It’s why some are so averse to investing because the risk is known. Downswings and losses occur with past performance no guarantee of future results. The stock market dropped over 1,000 points on Wednesday. It rebounded about 500 points by the end of this week.

For us, we’ll just ride the market roller coaster like we’ve done every time. If you never even attempt to invest or never allow yourself “to fail” through the drops and instead react in some way by adjusting your risk level or selling off, you’ll never understand how market risk works. You will never learn how long-term compounding works nor will you develop the skill of restraining your temperament that is needed to withstand market volatility. Or that gradually increasing risk with greater diversification can return more reward.

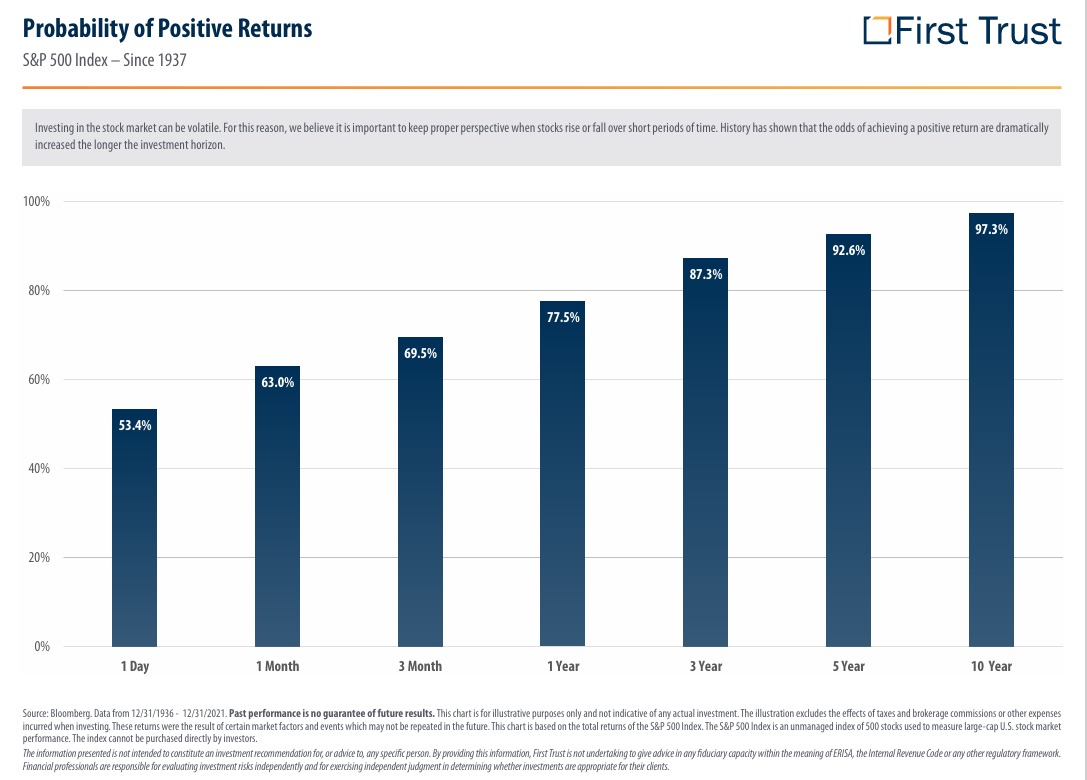

This is the probability of positive returns on the S&P 500 Index – since 1937. There is more risk early on in the short-term but the longer you hold, the greater the probability of a positive return. However, the caveat is always stated that past performance is no guarantee of future results.

At this point, we don’t have anything better to accumulate money for the retirement/freedom phase of life. Just like checks, we have to keep using them until something else completely replaces it. As proliferate as Internet resources have become, investment education is still lacking, and people won’t admit what they don’t understand (unless on Reddit anonymously). The Internet and now even AI can’t alleviate the fear in unexperienced risk – what we don’t see. It has to be lived, experienced. Once you do, you can accept it by understanding that “tail-end events” are all that matter, and you’ll never think otherwise. – Morgan Housel

Featured Image – Wilder Ranch State Park, a California Christmas circa 2017 – Photographer Cary Wauters

What you don’t see? The people on the other side.