We’ve become a culture of tangibleness. Where buying the car, wearing nice clothes, posting the travel pictures, having your dream place filled with lots of things, raving about you or your kids’ accomplishments…is gratifying, contributing to your 401(k) or IRA is not. There is nothing tangible about that. You have nothing to show for it. You receive no validation for your effort and hard work.

It’s hard to explain the value of something that builds ever so slowly far into the future that appears very inert or passive at the present. You can’t touch it; you can’t show it, and you certainly can’t humble brag about it. Will accumulating all these tangible things give you a better, happier life? Maybe. Or you eventually turn into your Parents who probably didn’t have a 401(k).

In the late 1800’s to early 1900’s just being alive past 40 or 50 was a reward in itself. There was no such thing as a retirement or a freedom phase of life. Life was about survival. The Silent Generation was born between The Great Depression and World War II and the Greatest Generation was coming of age.

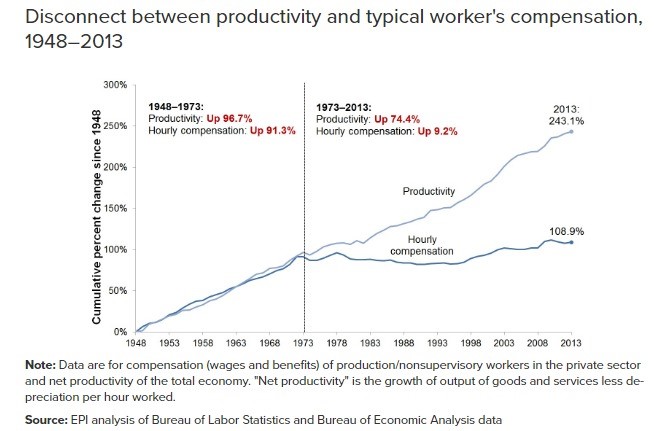

Wages and productivity grew at the same rate from the late 1940’s through the early 1970’s. People were compensated relative to the work or output they performed. It was tangible.

As efficiencies and computers developed and expanded, workplace productivity grew at a much greater pace than wages. Work became much less tangible and more difficult to measure. Worker output became less immediate as projects and thought work grew. Projects could take years and never be successful. What do you have to show for all that hard work?

Conspicuous consumption morphed into a tangible reward for all the work you did that was unseen. Even if you got a bonus or pay increase, no one knows that you did if you continually put that into your retirement plans. You need something to show for it or so we think.

Social media began to rise in the early 2000’s. It wasn’t just our family, friends and neighbors who needed to know the hard work we were putting in, it was all of our so-called connections, followers, acquaintances and people we’ve never met. It evolved even further when the trendsetting SMI – Social Media Influencer entered the digital domain who has a noticeably extravagant lifestyle that is certainly not intangible.

The definition of intangible:

- Incapable of being perceived by your senses.

- Having no physical presence.

- Difficult to define and understand.

Pensions were the first type of retirement plan dating back to 1875, a defined-benefit plan where the employer (company) sets aside money that is invested for the sole benefit of the employee. It could be viewed as a reward from your company for your hard work. Social Security was enacted into law in the mid 1930’s but was never intended to be a full retirement plan. The intent was to replace a portion of worker’s pre-retirement income. Understanding the Benefits (ssa.gov)

Retirement funding between the 1940’s – 1980’s consisted of pensions, social security, farms, land or business selling, extended family and excess wages earned. Pensions started being phased out in the 1980’s and companies began replacing them with 401(k)s, a defined contribution plan, where the onus is on you to contribute to the plan and not the company other than the matching contributions. The Demise of the Defined-Benefit Plan and What Replaced It (investopedia.com)

If you were self-employed or worked for a company that didn’t offer a defined contribution plan – 401(k), 401(a), 403(b), 503(b), the IRA – Individual Retirement Accounts (IRAs) | Investor.gov was introduced to all working taxpayers in 1981. Why is it even called the 401(k)? Because it and its relatives were named after the subsections of the U.S. Internal Revenue Code. How original, no thought of marketing psychology went into that decision. At least, the IRA actually has the word retirement in it.

It’s no longer the 80’s, it is 2024, 40+ years after the 401(k) was introduced and nearly 43% of America still don’t know what it is. Education on this is obviously poor but it is also intangible. What’s a 401(k)? Two-fifths of Americans admit they don’t know – Investment News

Investing in a plan like the 401(k) is more difficult than investing in stock of a company where you used to get stock certificates. Those were at least tangible, and you had a pride of ownership in a good-standing, profitable company. My grandfather invested in the stock of their local telephone company that has grown into a regional telecom provider. My Mom still has the stock certificates that she inherited, and she understands this.

The younger generations are figuring out how to get comfortable with the intangible maybe because their parents had 401(k)s or they are digital natives. They also understand that buying time is more important than buying things. There isn’t much out in the personal finance sphere connecting investing to being intangible. I like the concept of “hidden wealth” and the idea that “it’s difficult to learn from what you can’t see and why it’s so hard for many to build wealth,” that Morgan Housel writes about in his book, The Psychology of Money. I’m taking his intangible idea further. I think it has greater implications to your financial future.