It was the year 2000, not long after the dot.com bubble burst, my husband found our first house driving by it several times. There was no Zillow or Redfin to search on, no dream home photos on Facebook/Instagram to wish for, no fixer upper homes on the HGTV shows to aspire to.

It was the oldest yet amazing house I had ever seen. Built in 1844 of solid red brick, it did have electricity and plumbing, barely. We didn’t have a designer, YouTube guides or influencer reels, just a contractor, our imagination and hard work, laying ceramic tile was the hardest.

Technology has changed how we view and navigate life. It has impacted our priorities and how we spend money. It has inflated our perceptions, our frame of references and our expectations.

It has given us far more than we could’ve ever imagined and, in many ways, abundantly. What we don’t realize is how it has inflated our thinking and decisions.

Back in 2000, we didn’t have to decide what smartphone version we should upgrade to, what data sharing plan we should get, what apps and subscriptions we needed, what service provider to use, what accessories we needed and how to integrate them into our flashy vehicle.

Now, we search Google for destinations, where to dine out, search the menu and amenities, read the reviews and make reservations. We outsource food with the convenient apps of Grubhub, DoorDash, UberEats or whichever local restaurant or have ready-to-prep meals delivered to our door from HelloFresh or Home Chef.

Whenever we need something we Amazon or Target-run it.

So, why hasn’t technology inflated our investing and how we save money? Are we so consumed with having the latest and greatest, most convenient and glamorous that saving and investing for our future isn’t a priority?

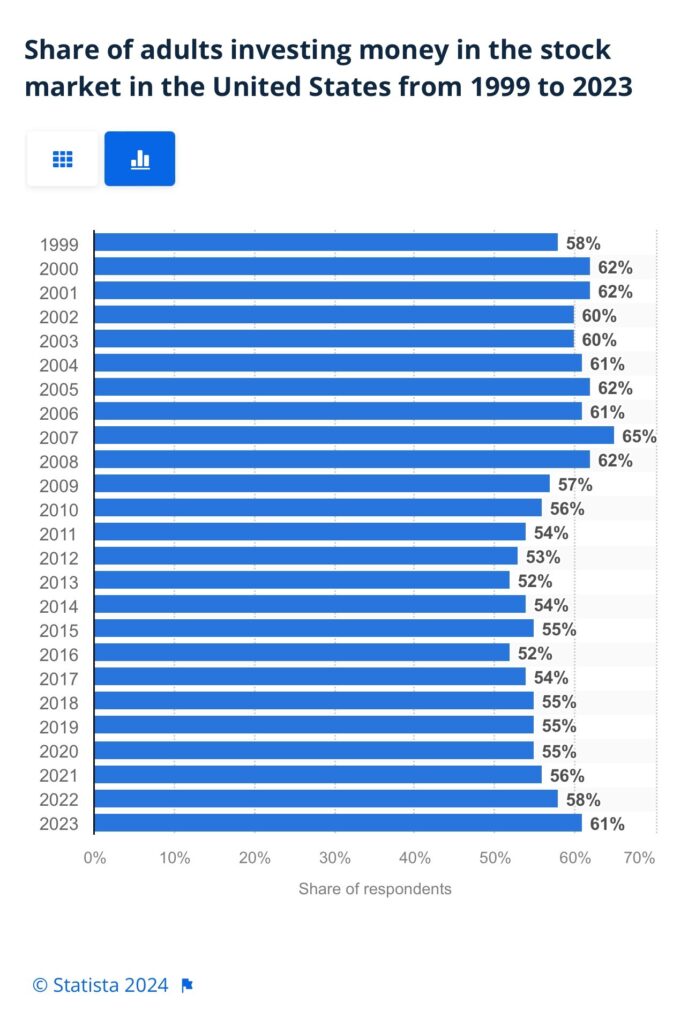

Looking back again to 2000, investing continued to grow until the housing market crash and only in 2023 has the percentage crossed back over 60%, with essentially no growth. Coincidentally, the first iPhone was released on June 29, 2007.

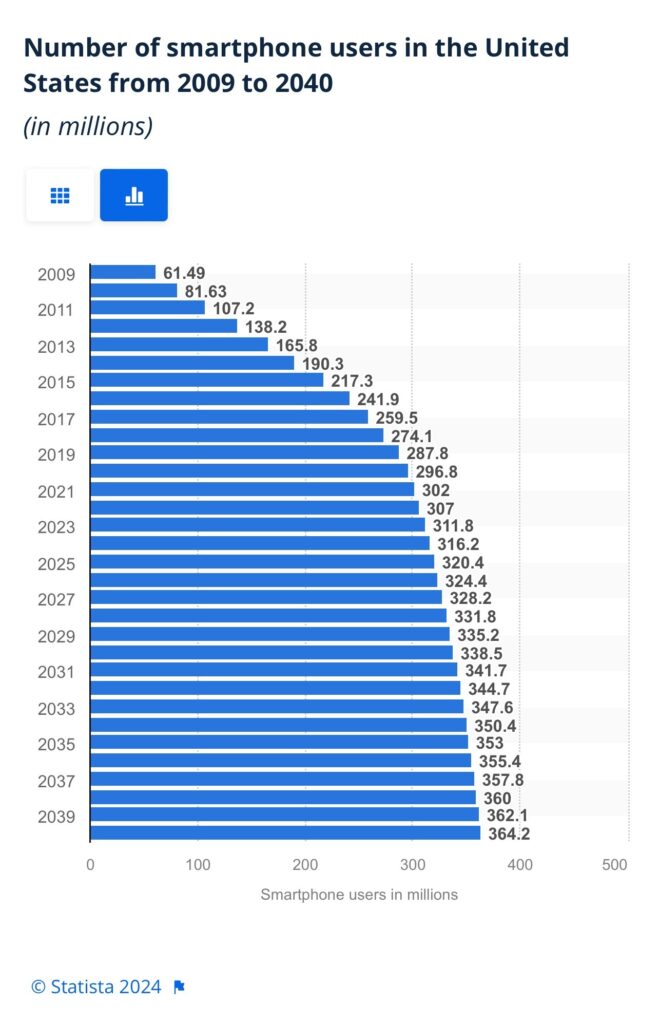

In 2009, 20% of Americans owned a smartphone and investing began its precipitous decline. Over the next 14 years, smartphone ownership increased to 91% among Americans. Incidentally, I can’t find any data, statistics or studies that correlate the rise of the smartphone to the decline in investing. Interestingly, though, the current smartphone market is nearly saturated and only now do we begin to see an uptick in investing again. Also note, the percentage of Americans investing actually increased after the dot.com bubble implosion in 2000.

The reason why 55% of Americans weren’t investing according to a 2018 GOBankingRates survey was because they didn’t think they had enough money to do so. The Reason 55% of Americans Aren’t Investing | The Motley Fool

If you aren’t maxing out your retirement fund yet or don’t think you have enough to start an additional index fund account, here are some ideas to consider.

Housing

No matter where you live, it will never resemble the perfectly curated abode that you see in Facebook/Instagram reels, pictures or fixer upper shows. There will always be something that needs to be changed or updated. Our house in California had popcorn ceilings to the day we sold it in 2022. Our current house needed new windows, roof, driveway all very large expensive projects. If we wanted to continue to invest, we had to strategically plan these replacements out.

Dining Out

Average American households spend more than $3,000 annually dining out, with some spending much more. You don’t have to completely give up a nice dinner out to cut this cost significantly. Instead, be strategic about when you dine out and how much alcohol you consume. The $5 coffee isn’t the investing killer, it’s the multiple drinks at $15 a shot. Also, be sure you are tipping on the sub-total for food. Most of the pre-printed, suggested tips are calculated on the fully taxed amount.

Convenience foods & Outsourcing food (most regretted)

Bring snacks and drinks along with you or purchase them at grocery stores when away from home. Gas stations, hotels and airports are notoriously overpriced. If you are truly serious about investing more and can’t, stop the food deliveries.

Grocery store App & Loyalty rewards

Almost all grocery stores have an app for in-store digital coupons and loyalty program that if used can save you significant dollars. How grocers have leaned into loyalty | Grocery Dive Since we moved in 2022, we have saved over $2,500 at our local grocery store by frequenting the same one redeeming loyalty points and digital coupons. If you are still reluctant to have your food purchases tracked, just know that everything else you buy, or post online is also tracked.

For more ideas on how to find investing money: Everyday luxuries: Where are people overspending? | Empower

I never started investing for any specific reason, only that I knew if my first job out of college offered a 401(k) or similar retirement plan, I had to contribute to it for the tax savings and company match. We also learned to live on less contributing more each year with annual increases and bonuses.

When that time came to put a down payment on our first house, we didn’t have enough accumulated in savings and had to borrow against my 401(k) since my husband had just started his after finishing grad school. In hindsight this wasn’t the best approach, but it taught us that borrowing against a retirement fund is expensive, all loans are not equal and needed to be prioritized to be paid off first.

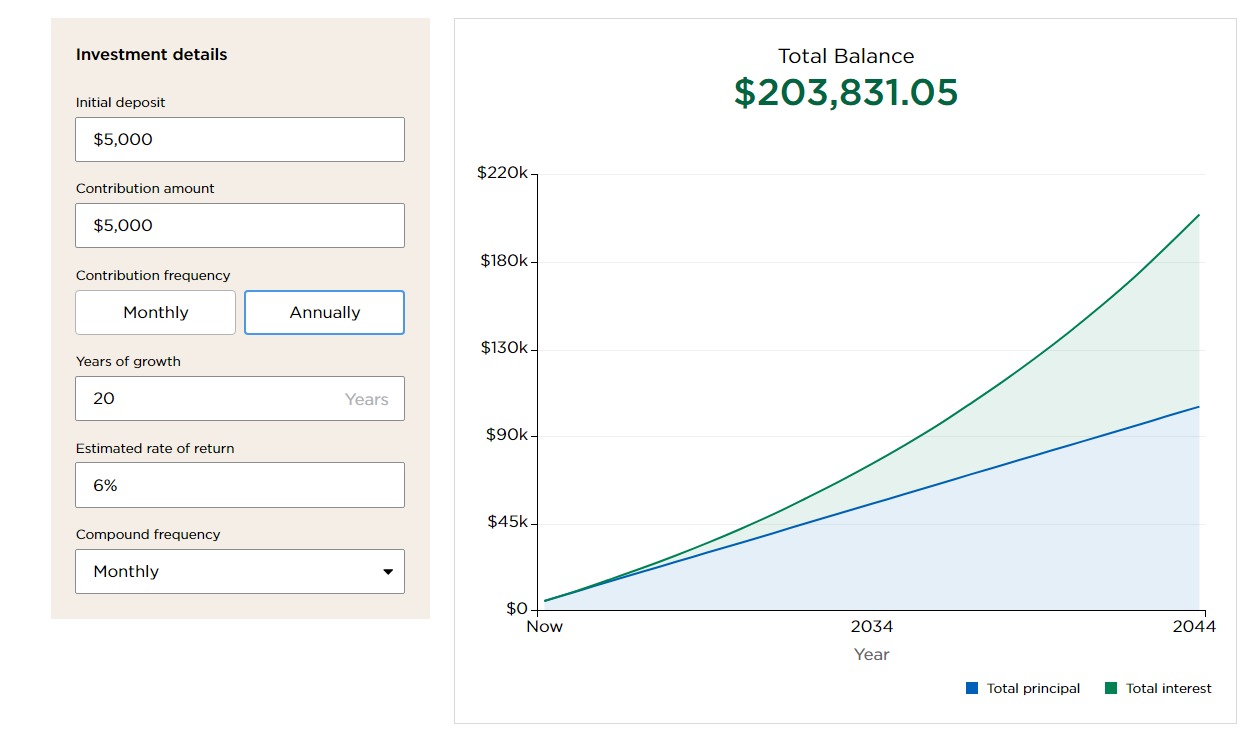

For the additional $5,000 you invest every year for the next 20 years, your future self will thank you. That additional $200,000 is significant compared to the relatively insignificant sacrifices that you have to make.

Investment Calculator – NerdWallet