Sometimes procrastination is avoidance of the unknown. Trading that insider comfort of the known by avoiding the discomfort of discovering the unknown and the subsequent consequences.

Back in February, I wrote that I needed to set-up my own Apple ID. I did some research on how to do this, successfully, and didn’t find much information other than a few having done it and the logistics of how they did it. It seemed straightforward and yet, I balked at actually doing it. Until, about a month ago when my husband and I both had earphones on working outside on our deck and every time we stopped to talk to each other, his Airpods would default to my iPhone, causing lots of frustration.

The next Saturday we were still in the same situation. So, I just did it and it didn’t go as planned. All the things I planned for weren’t needed and all the things I didn’t plan for happened. No further amount of research would’ve helped. We shared Apple Music long before there was a Family Sharing plan and the algorithm.

In trying to figure out what happened, I switched back and forth from my husband’s Apple ID to mine which made things worse. Apple Music blocks you for 90 days if you do this for pirating reasons. I had to Ask AI by typing in very specific questions to Google and wait for the AI Overview to tell me “Yes, this has happened before,” assuring me I wasn’t an idiot.

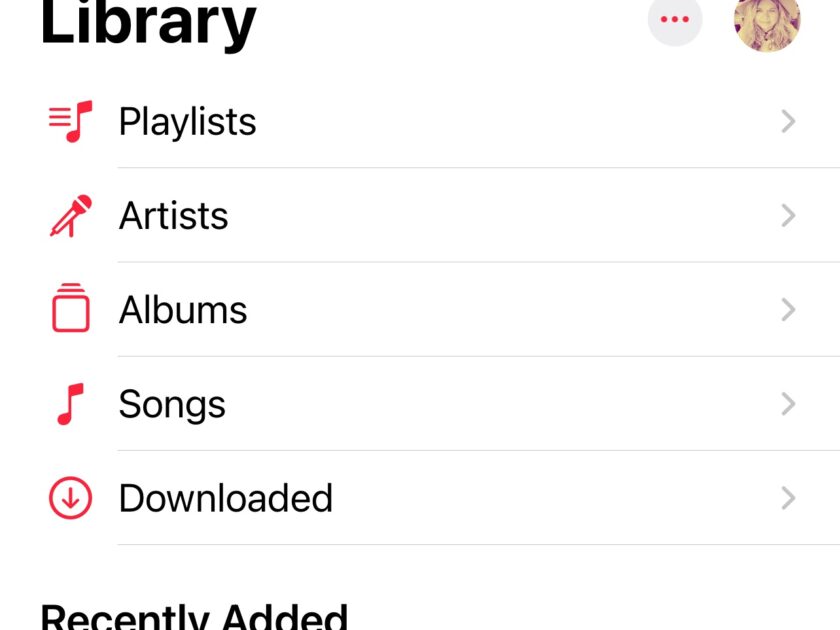

The only music that was left on my phone was from what I downloaded back in the “old days.” My playlists were still there but few songs. Years of discovered and organized music, gone. And since I was blocked, I couldn’t start rebuilding. So, I programmed the local radio stations in my vehicle and at least had my Shazam tracks. I was only blocked for a week on my phone and a month on my computer. I think because I originally had an Apple ID but had stopped using it.

Even after I got the Family Sharing to work as it should, I realized that the music algorithm does not know Andra Wauters and suggests nothing. Everything I had listened to, and all my playlists were created under my husband’s ID, which is the reason he told me now why he switched to YouTube Music. He would always get my suggested music because I ruled the algorithm. I listen to music on flights and while driving. In 2019, I was on something like 26 flights, a record for me. Now, I drive 16 hours roundtrip to aging parents every few months.

At the onset of Apple Music, I was profiting from using my husband’s account paying for downloaded music only once which now has become the norm. With the onset of online trading, insider trading has taken on an entirely different level. Could it become a norm, it’s too early to know.

We all think of Martha Stewart going to jail for insider trading when in fact she was only convicted of lying to federal investigators and obstructing justice. At the onset of the COVID-19 pandemic, reports highlighted trades by bipartisan congressional lawmakers and their selling of significant amounts of stock came to light, raising legal and ethical concerns on the strength and compliance of insider trading laws.

Nancy Pelosi has become the most prolific trading member of Congress. She and her husband have faced rising scrutiny over their trading patterns, which have resulted in significant personal financial gain for them. Unusual Whales, a financial start-up, began tracking notable market activity and recently compiled data on lawmaker trading activity. Why? According to their CEO, “when you’re a trader or an investor, you’re looking for some sort of edge, and people believe this is a sort of edge.”

And with that comes the latest innovation, an app called Autopilot. It is designed to track and disclose congressional stock trading activity within about a two-week delay. Autopilot then discloses lawmakers’ trading portfolios to the public. Their most popular autopiloting: The Pelosi Tracker. There is another subscription-based trading platform, Quiver Quantitative, tracking Pelosi, Marjorie Taylor Greene and J.D. Vance. If you’re the right type of investor and want in on this, at least base only a portion of your investable assets into these platforms.

Because here’s the caveat, my life circumstances and yours don’t even remotely resemble that of Nancy Pelosi or other members of Congress. It’s inevitable that Nancy and her husband will die someday and then what? Unraveling investing is far more complex than an Apple ID. To spend years basing your investing on someone else could cost you more in the long run even with having that edge. It’s not only the monetary cost but that intangible cost of comparison, especially when your success will never match up to theirs.

Unusual Whales: Options Flow, Stock Data, Trading Tools & Analysis

Autopilot investment app attempts to redefine the way money is managed | Fox Business Video