They are inevitable every Spring. However, cherry blossoms are far more lovely to gaze at than pages upon pages of complex, repetitive tax documents we prepare and review each year.

I gave up doing our own taxes when I was in grad school while working and my husband wanted to claim our two cats at the time as dependents. So, we began to outsource them and finding a good tax professional is worth more than you may think, especially when your circumstances change often.

We’ve lived in 6 different states and the companies we’ve worked for have been acquired multiple times. It’s fodder for tax stories. One year our return was delayed by the reviewing CPA, and I had to review it, print and sign forms and then fax them while on a business trip, not ideal for security and privacy. The year my husband’s company was acquired the first time, he received a payout on stock options from Ireland, who didn’t care about US taxation. Our CPA at the time who was very experienced admitted to us the day before taxes were due that he couldn’t figure it out. So, we had to cough up a lot of money to file an extension. Even when we found another CPA from a top-tier firm, it took all three of us to review a data-dumped Excel file that would provide proof for the basis.

He works for a Japanese company now that does have a large US presence. But in recent years we’ve learned about the “pro-rata rule” for Backdoor Roth IRAs and why it wasn’t right for us.

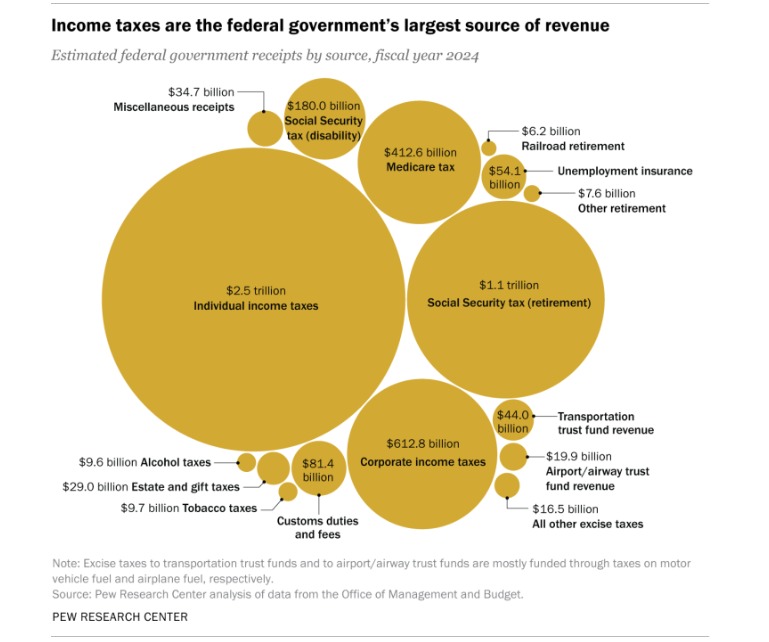

Income taxes are the largest source of revenue for the US Federal Government. Even if you are living in another country permanently, like my brother in Hong Kong, you will need to pay your share of US Income tax. A couple of times we explored moving to Switzerland or Japan who have reciprocal tax agreements with the US, but it didn’t work out for various reasons. United States income tax treaties – A to Z | Internal Revenue Service

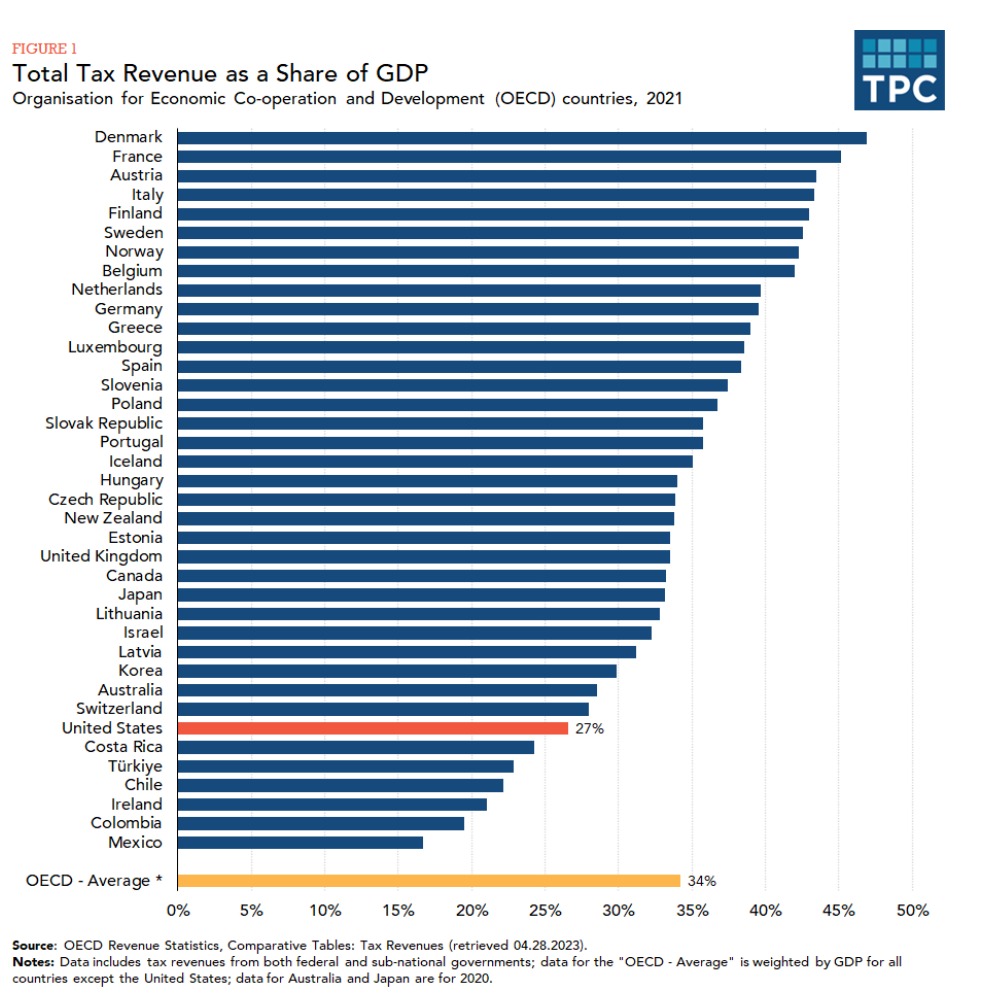

When we look at US taxes from a broader worldview, we shouldn’t complain as we keep a far greater percentage to discern how it should be spent or saved than many citizens of other countries. This is how US tax revenue as a share of GDP compares internationally.

If you think your tax preparer, accountant or CPA firm is behind the times, you need to know what they deal with to put this into perspective. The IRS uses hundreds of applications, software, and hardware systems that are outdated, some 25 years or older, or written in a programming language that is no longer used. The Individual Master File (IMF) is the primary system used by the IRS during tax season. The software is one of the oldest in the federal government, accounts for trillions of tax dollars each year and holds about 60 years’ worth of data.

The U.S. Government Accountability Office found that the IRS has spent hundreds of millions of dollars trying to update this system. However, IRS officials said the system wouldn’t be fully replaced until 2030 at the earliest when it will be 60 years old. A new IT roadmap for the IRS should be unveiled in the next few years. In the meantime, some things you should know about taxes and technology.

Audit Reveals IRS Has No Plan to Retire Old Tech: Why It Matters | Kiplinger

Outdated and Old IT Systems Slow Government and Put Taxpayers at Risk | U.S. GAO

And for those who have income from illegal activities, just know that this is also part of the US Tax Code.

Wishing you a boring, uneventful, predictable and legit tax week.

Featured Image Miyajima Island, Japan, where the tamed deer want to be petted – photographer Cary Wauters