Much has recently been written about the US residential housing market. We all know that demand is far outpacing the current supply but it goes deeper than that. Surface level issues are easier to pinpoint and the nuances harder to understand.

I have a unique perspective in that I have experience buying 4 houses in 4 different states and selling 3 houses in 3 of those states.

• Buying the first house during the dot.com bubble in 2000.

• Selling the second house and buying the third one during the housing crisis in 2008 – 2009.

• Selling the third house and buying the fourth one during a pandemic in 2021 – 2022.

• I worked in real estate investment and homebuilding for several years.

The most recent research I found fascinating and the unconventional considerations I propose affecting the current housing market are often not written or talked about. While these may not be direct causes of the limited housing supply, they certainly could be factors contributing to why the supply doesn’t increase to match the corresponding demand of the buyer.

Technology Inflation

This is technology inflation. As a first-time homebuyer, your house is not going to look like this unless you have affluent parents helping you which is happening, or you have made considerable cash and have that cash on-hand. The house size, modern windows & door, outdoor lighting, perfectly curated landscaping and driveway are all expensive in 2024. I uploaded this photo to Google Lens search and found it is an iStock photo. The search did find two similar houses in Miami, one for sale at $723,000 and another one previously for sale estimated at $1,029,955. The media and social media inflate our perceptions, our frame of references and our expectations. Some homebuyers could be waiting out the market to afford this type of home in the future because what they currently can afford does not fit this expectation.

Airbnb, VRBO & Real Estate Investing

A recent study was conducted that suggests Airbnb home-sharing has led to increased residential rental rates and home prices even though Airbnb denies this. While the 2.25 million US Airbnb listings may not all be homes, there is some housing component that could be rented full-time, or a 2nd house that could be sold.

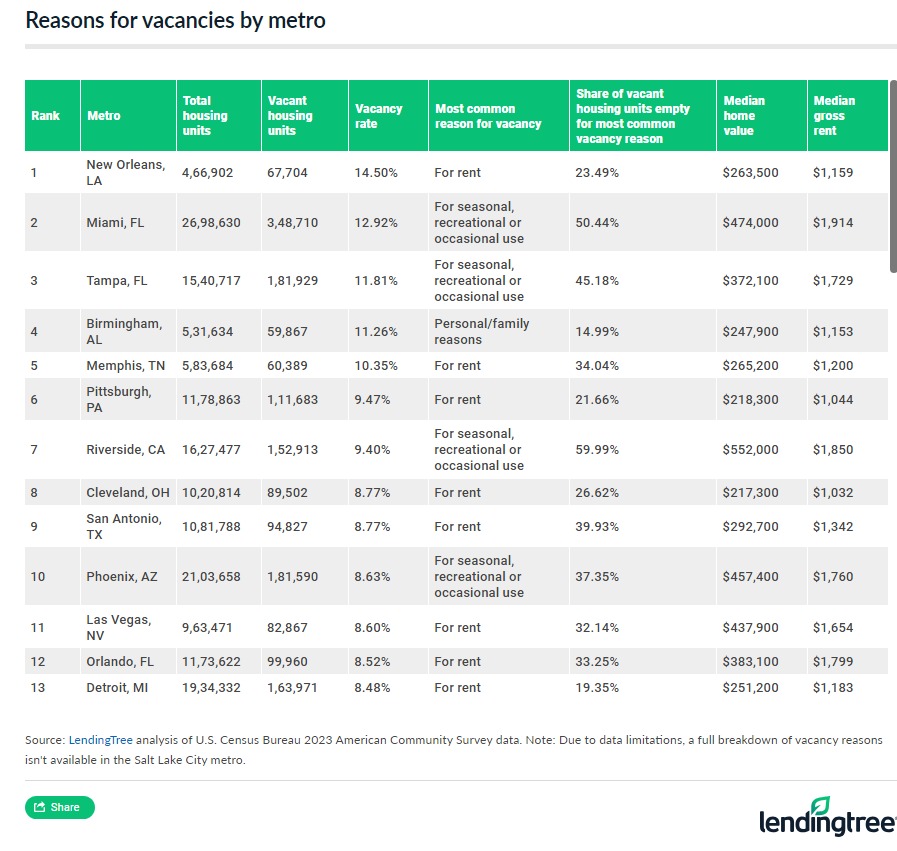

A study by LendingTree analyzed the 5.6 million vacant homes across the 50 largest metropolitan areas revealing the following reasons.

Study: Vacancy Rates in Largest US Metros | LendingTree

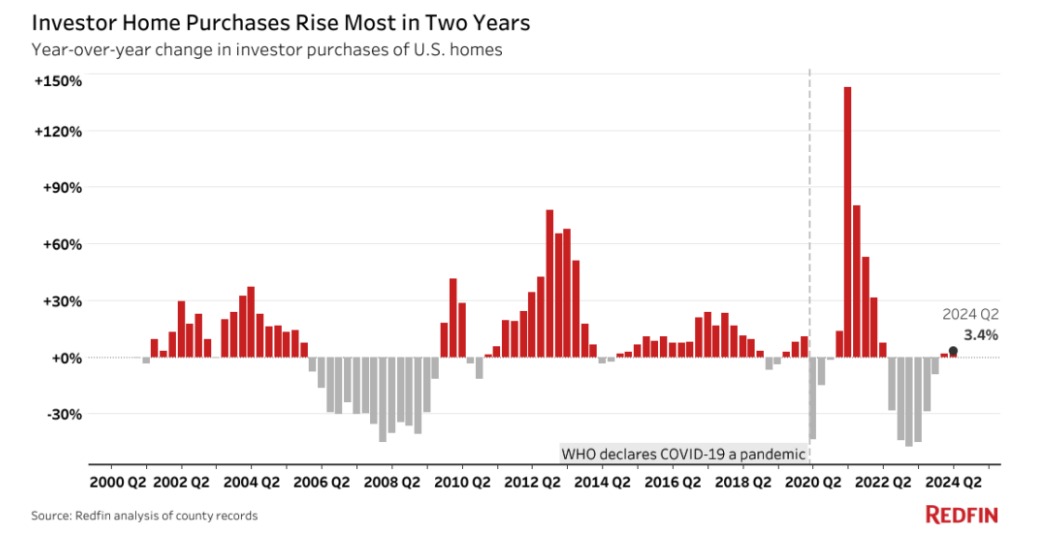

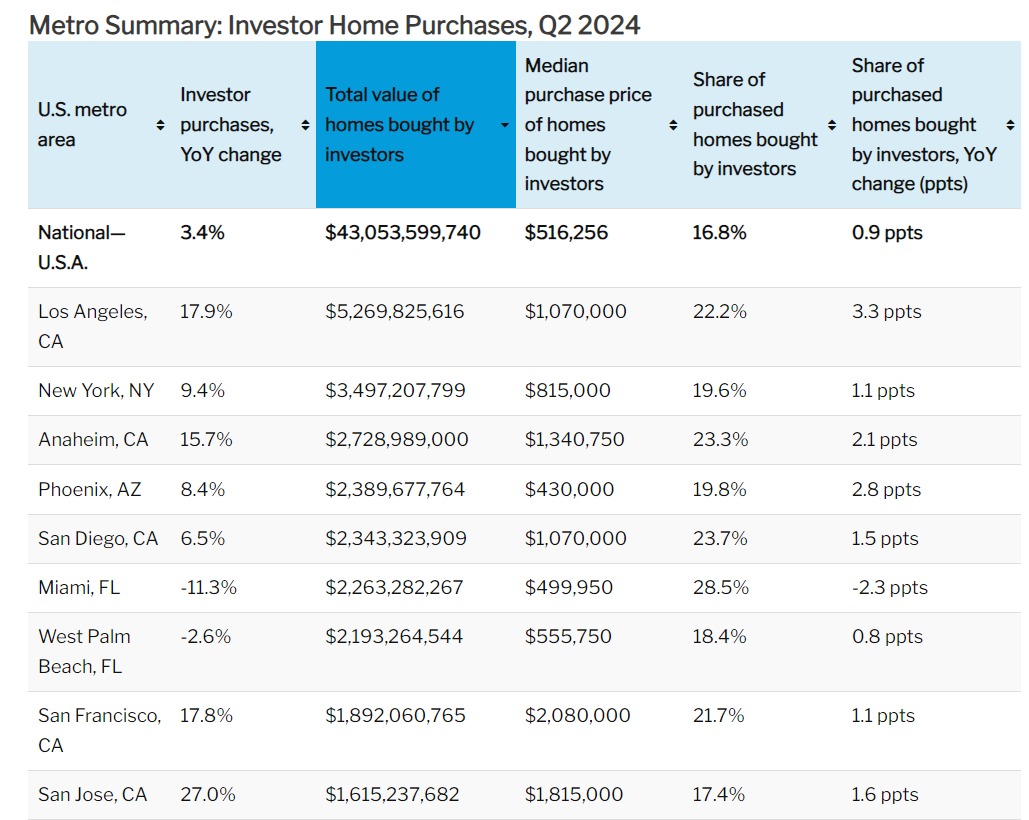

Redfin recently published data on the increase of real estate investors’ home purchases. It’s more institutional investors & private equity, not the real estate investors posting that you should forgo contributing to your 401(k) to invest in real estate instead.

Q2 2024 – Investors bought 1 of every 6 U.S. homes that sold—purchasing $43 billion worth of properties—and 1 of every 4 low-priced homes that sold.

The increase in investor home purchases during the pandemic when mortgage rates were the lowest is pronounced. Who’s to say that won’t happen again if rates go that low?

While investor purchases decreased in Florida cities, it markedly increased in cities in California. It is the reason why we could not buy a house in Los Angeles during the housing crisis when home prices were low and available to purchase.

Investor Home Purchases Post Biggest Increase in Two Years

Cash

Having an unexpected 2 mortgages after moving to Albuquerque in 2006, when we finally said yes (3rd offer) to move to California we rented a Pod. We packed up our most needed things in June 2008 and wouldn’t get the rest of our furniture and belongings until August 2009.

After 8 years of living in a house, we had to wait the housing market out 15 months in a 1-bedroom apartment with a loft along with our bass guitar playing neighbor who was unbelievably loud.

House after house we put an offer in, we ultimately ended up losing. We eventually figured out we needed more cash. We didn’t have any cash. It was all tied up in our Albuquerque house and we had no reserve built because of the 2 mortgage payments in 2006.

In July 2009, we finally sold the Albuquerque house and got enough cash to make a sizable down payment on a 1,900 sq. ft mid-century 1965 house with the authentic kitchen cabinets true to that era, popcorn ceilings and a pink flowered bathroom for $667,000 with a 30-year jumbo 6.5% mortgage. To us at that time, this was hard to fathom but that is what we could get for reasonable commutes to work.

I learned we needed cash for wherever we bought our next house. For years, I built up significant amounts of cash in several accounts forgoing other investment opportunities. So, when that day came in December 2021, we could make that considerable 20% down payment in cash. May be that’s why Millennials are hoarding cash now. They are getting beat out of the housing market by those who do.

Relocation

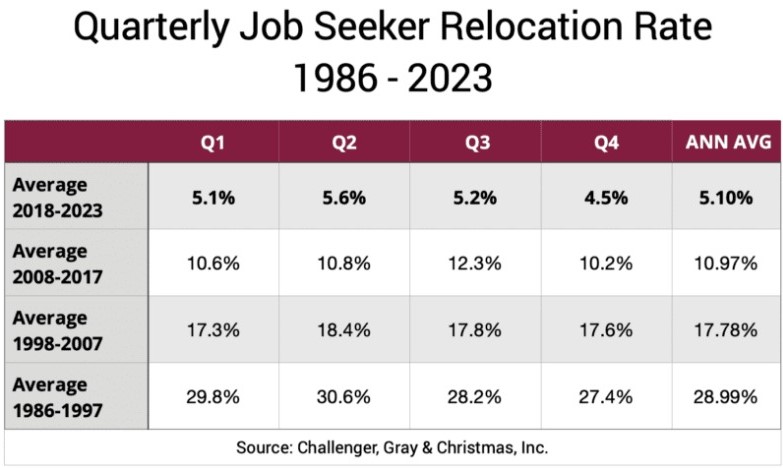

Relocating for a job became almost nonexistent in Q4 2023 at 1.5%, the lowest level on record. It rose to 2.4% in Q1 2024 but pales in comparison to the relocation rates of late 1980’s – 1990’s.

Succession planning has become local by identifying talent early to fulfill future vacancies. Technology advances and shifts in office locations have also contributed to this decline. People are far less willing to relocate now than they used to be. It was evident to us when we moved in 2022. We were able to get movers much faster than 15 years ago and the hired labor was far less experienced as if they had no experience or even training.

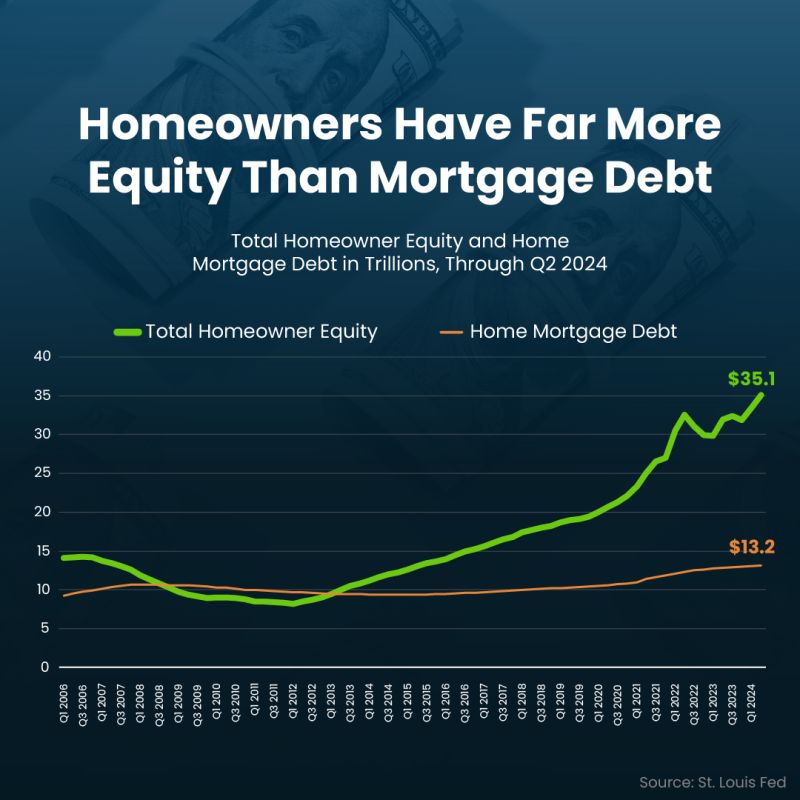

Most homeowners are locked into fixed rate mortgages at lower interest rates and are building considerable equity. Or they are like 40% of homeowners with no mortgage at all and don’t want to upgrade back to a mortgage with a high rate of interest.

On the show Love It or List It, where Hilary and David compete to impress the homeowner with current home improvements or finding the perfect new house, more often the homeowners chose to love it and stay. With less relocation and more home improvements prevailing, there are less older homes available to purchase. And when they do come up for sale, they are often higher priced due to the improvements made.

The feeling of home, memories, family and community are especially important this time of year. Count your blessings, then subtract them away as if they weren’t there and you realize how fortunate you really are. Have a safe and Happy Thanksgiving!

Next week: Part II