Cold, hard cash in the refrigerator/freezer, the pantry/laundry room, closets, in random books, in a safe not bolted to the floor or wherever creative place you have come up with to stash your cash.

The best place is in a safe but it has to be bolted to the floor. In CA, ours was initially not and thieves hauled off with a large one hidden in a closet, down the stairs and out the door. Insurance covers very limited cash.

There is a new trend emerging in 2025 that I increasingly noticed in 2024. Credit card fees are being directly passed on to the customer or checks, debit cards or cash payments are only accepted. Restaurants, medical offices, contractors, local stores and small businesses and governments are all being more direct in passing these fees on to you instead of raising their rates and prices to remain competitive. Checks and cash could be making a comeback. As mobile payments get more ‘painful,’ cash could make a comeback Credit card processing fees are rising. Will Americans pay the price?

The summer I sidelined my biology major, I took accounting classes at Iowa State University. It’s where I met my husband. To live there, I worked at a Wendy’s, in the single drive-thru window making change and handing customers their orders while someone else continued taking orders at the cash register. It was a pre-dated model to the current Chic-fil-A one to keep the drive-thru line moving. Now most have two windows, one for payment and one for food. It was a time when few paid by credit card and there was no such thing as an “app.” I got really good at the now lost art of handling cash.

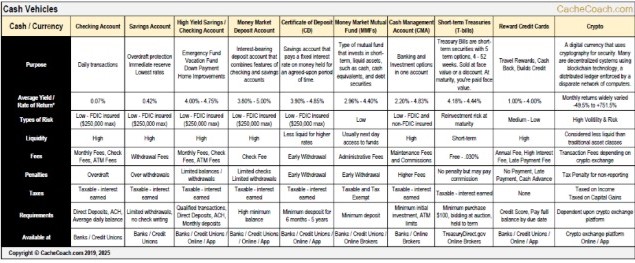

Cash is the most liquid and least risky asset that you own. It’s a savings vehicle for emergencies, down payments, home improvements and travel. However, it is a short-term investment that shouldn’t be relied upon for long-term endeavors. Here’s where you need to know your rate of return or interest rate as it changes often.

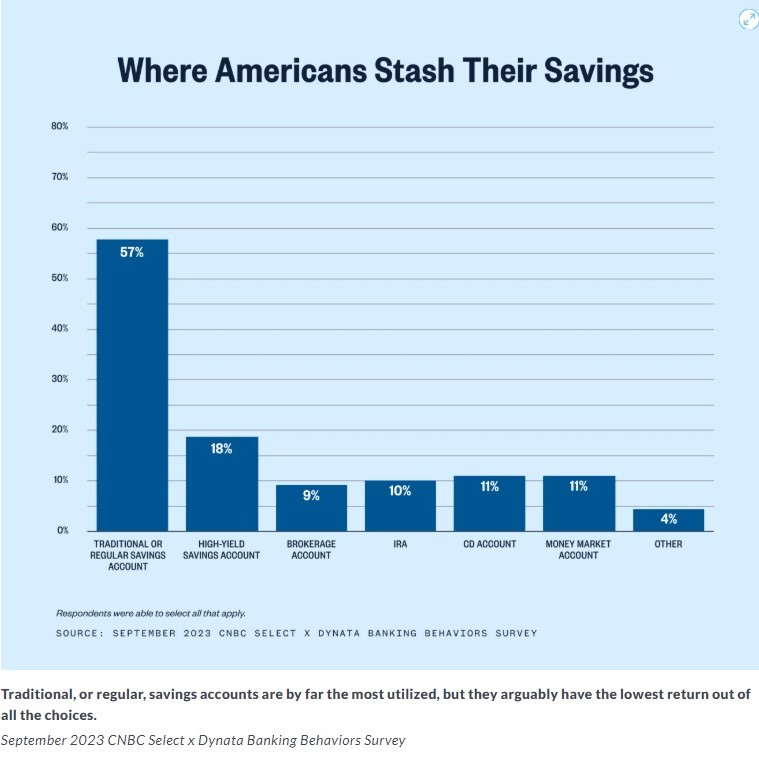

Many Americans are missing out on higher interest rates by keeping most of their savings in a traditional or regular savings account with the lowest interest rates. I think much of it is due to not knowing what other options are available to them. Many of the higher interest-bearing accounts have rules and limits along with penalizing fees that some may want the freedom of access and withdrawal instead.

Back in 2019, I came up with a reference for each type of financial vehicle because I wanted to know and understand all the options available but couldn’t find anything like this. This is the first section for Cash Vehicles. I built similar for Securities, Retirement, Education and Alternatives.

It wasn’t until August last year that I realized I should share this more widely. Initially, I had built it for myself, then shared with some. Talking about personal savings options is not a topic most Americans seek out given 57% continue to use traditional checking and savings accounts. Financial literacy in the US in 2024 has actually declined 12% since 2009 (smartphones became mainstream early 2010’s). Financial Literacy Statistics (2025)

We should know these things, but we hesitate to take the time to learn or won’t admit that we really don’t know. Other priorities, distractions and comforts take our attention. Financial words and descriptions are often unanimated and meaningless unless a visual, comparable image is created to “see” it. It’s why graphs and charts are becoming more prevalent, to create the same effect of what our attention seeks to see on our screens each day.

In this new year, be cognizant of where your attention is. It can’t always be short-term. Take the time to focus on the long-term strategic, to understand and get comfortable dealing with the unknown, intangible, hard-to-grasp concepts. It will take you into uncharted territory away from your safe harbor, but the exploration and discovery will be worth it just like it is when you travel to new destinations.

A well-written overview of crypto.