There is a plethora of writing and books on the emotions, psychology and mindset of money. There is even more abundance on the tactical management of money from optimizing your credit score, building an emergency fund, budgeting, getting out of debt, investing 101 to retirement. Trendy, in-depth topics like FIRE – Financial Independence Retire Early, minimalist, nomadic living, side hustles and other life & money hacks fill the online space. However, there is little on the strategic, research-based management of your money with modern day technology.

Why? Is it boring to write about being strategic with money? Is it not trendy?

There still are a number of investing, retirement, advanced money blogs online. A few are really good but to me, many appear dated, with so much information packed into a single post that it becomes tedious to actually read. It takes a certain kind of person with a very intentional, focused and determined attention span to dig through these websites to not only read but also understand the sometimes-convoluted content with lots of distracting advertising mixed in.

I don’t have a good answer yet, but I do have an idea. I was literally writing another article to publish and this thought became front and center in my head instead. So much so, that I am setting a goal to post something every weekend, which means I need to begin writing ahead to accommodate travel and other life priorities. But before I could write ahead, I needed to find a niche I believed was worthwhile to write about and gather some feedback.

The term “blog” I have never liked because it elicits a notion that the writing isn’t necessarily trustworthy because blogging started out as personal reflections and has recently become a dated commodity. Still, I believe writing is important, especially for complex, consequential topics and for those of us who are visual learners. I rarely listened to podcasts until recently now that many have visual video content with closed captions.

A 2022 survey conducted by Investopedia asked all four generations where they get their investing information and it is friends, family, and the Internet as go-to education sources. Financial Literacy Gaps Across Generations (investopedia.com)

Behind digital currencies, investing and retirement are the least-understood personal finance concepts. So much of the online content for these subjects is broad and generic especially to fit the LinkedIn optimal view model, fast and sketchy on the YouTube/X influencer/bro model or highly technical for the industry experts with not much in between. I see so much that isn’t explained well leaving so many not really understanding.

To fully understand, there are fundamental things you must be aware of first. These topics along with the technology ones, are rarely written and talked about in substantiated, relatable detail aside from books that aren’t industry driven.

- The pertinent differences between public vs private companies, how they do business, make money in modern times

- Big, public companies – how they are not inherently bad

- 401(k)s and IRAs

- Asset classes

- Stock market

- Risk

- Turning investments into reliable cash flow when the time comes

- Inflation

- Taxes

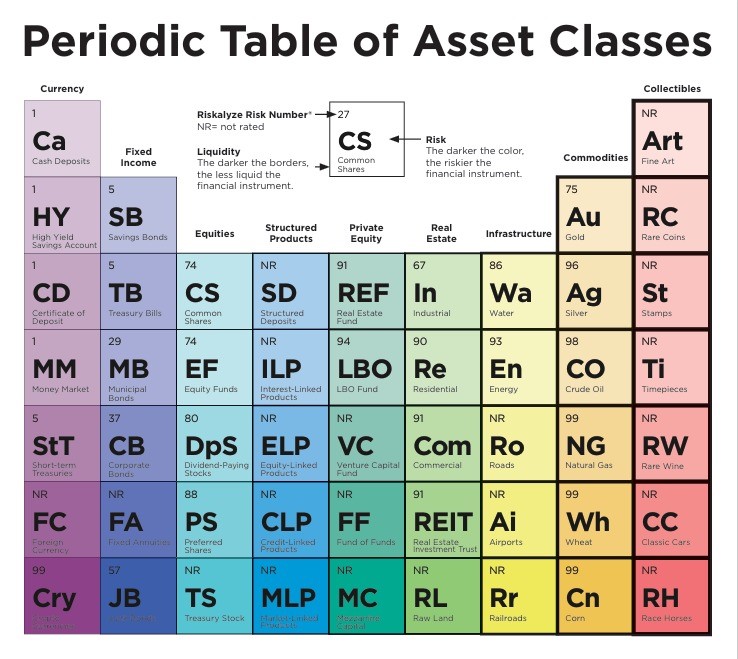

As a kid, I remember the commodity reports on the local news at noon with the prices of corn, beans, wheat and pork bellies. My brothers and I would always laugh with a sarcastic remark on pork bellies reporting. I learned corn was risky but didn’t realize how much it was until I saw this table.

The table below is really good but even to me it is hard to read and there are things on here that need more explanation. I had created something similar a while ago, but it needs more work because a) I want to know and understand myself and b) will share with those who are truly interested.

periodic-table-asset-classes.pdf (wealthmanagement.com)